Savannah Resources

Review of 2018.

Or

Trials and Tribulations

of a Troublesome Teenage Genius

I’ve been meaning to write this

for a little while now, as I’ve said infinitum Savannah Resources is a jewel in

the cesspit of AIM. Its projects are on the whole exceptional and its

management team highly experienced and successful.

However its far to say that 2018

has been a troublesome year for Savannah, its reached new highs, raised sums of

money at levels that are envied by most companies. It’s created alliances and

expanded its team. It’s advanced projects and done considerable work to add

value. Despite all of this, the share price is currently lower than at this

time last year. In my mind of normalising a company’s characteristics, it seems

to resemble a “Teenage Genius” that has had a troubling year. It’s been affected by the bad behaviour of

those around it, notably the tribulations of the Lithium Market over the past 6

months and the declining fortunes of its peers. Also weighing heavily on

Savannah are the trials of Oman.

This review will hopefully put

2018 in to some perspective and shine a light on what to expect in 2019.

Mutamba Mineral Sands Project, Mozambique

“Savannah

has a Consortium Agreement with Rio Tinto, which became operative in October

2016, to define a potential dry mining operation for staged, early development

in a world-class province in Mozambique…Savannah is the operator of the Project

and may earn up to a 51% interest in the combined project as it moves towards

production through scoping, pre-feasibility and feasibility studies….The global

Mineral Resource estimate for the Mutamba project (Jangamo, Dongane and Ravene)

currently stands at 4.4Bt at 3.9%total heavy minerals ("THM")

comprising both indicated and inferred category material and containing

ilmenite, rutile and zircon This includes a high-grade portion of 92Mt at 6.2%

THM, which was defined at Ravene. Importantly, significant potential

remains to expand the resource beyond its current boundaries, which will be the

focus of future prospecting activities.

· Targeting first production in 2020 with average

annual production of 456,000t of ilmenite and 118,000t of non-magnetic

concentrate

·

US$4.23 billion LOM revenue forecast based on

Management Case Two (base case revenue of US$3.53 billion forecast)

·

Pre-production capital expenditure of US$152

million plus US$74 million of contingency, EPCM (Engineering, Procurement,

Construction Management) and spares, with identified opportunities that may

reduce capital expenditure (based on conceptual estimate +/-35%)

Rio Tinto will

be providing all its existing camp, facilities and associated equipment, and

the Consortium Agreement includes an offtake agreement on commercial terms for

the sale of 100% of production to Rio Tinto (or an affiliate).”

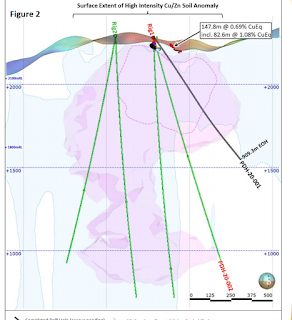

Block 4 and 5 Copper Projects, Oman

“Savannah has

rights to two blocks covering 1,004km² in the copper-rich, Semail Ophiolite

Belt in the Sultanate of Oman, a region proven to host clusters of moderate to

high-grade copper deposits with gold credits..The Company’s strategy is centred

on building a copper and gold resource inventory to support high margin, low

cost operations and establish Savannah as a commercial producer, with mining

expected to commence in 2018…Block 5 has a current Indicated and Inferred

Mineral Resource of 1.7Mt at 2.2% copper ('Cu'), including a high-grade zone of

0.5Mt at 4.5% Cu, which was defined at the Mahab 4 target. This resource has

been delineated at the Mahab 4 (1.51Mt at a grade of 2.1% copper for 31,500t of

contained copper) and Maqail South (0.16Mt at a grade of 3.8% copper)

deposits.. This has led to the projection of an Additional Resource

Target between 10,700,000t and 29,250,000t grading at between 1.4%/t and 2.4%/t

copper with additional gold credits.*”

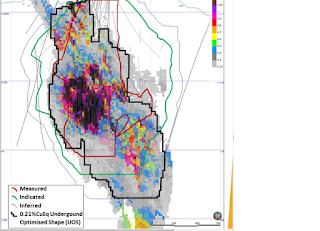

Mina do Barroso, Portugal

“Savannah acquired a 75% interest in the Mina do Barroso Lithium Project

in northern Portugal is Western Europe’s largest new spodumene lithium

discovery….a highly strategic opportunity to become the first significant

lithium producer in Europe. With a granted Mining Lease (valid until 2036,

extendable for 20 years), a 20Mt Mineral Resource which has the potential to

increase further, robust project economics, established infrastructure, and

preliminary metallurgical test work indicating that a high-grade (over 6%

Li2O), clean, low iron spodumene concentrate can be produced.

The project has a current Mineral

Resource of 20.1Mt at 1.04% Li₂O for 209,000t of contained Li₂O. Of this,

16.4Mt at 1.04% Li₂O for a total contained Li₂O of 171,400t has been defined at

the Grandao deposit, with ~90% now reported at the higher confidence Measured

and Indicated category, which represents the first 4-5 years of the mining

inventory.”

2018 (imagine this scrolling like a

starwars movie intro……)

We start the 2018 story in an all too

familiar way for junior miners.

The Mozambique PFS has been initiated

but will take many months.

Oman is awaiting magical signatures for

its mining license.

Portugal is still new, young and very

much unproved….

New Investors are sought amongst the

stars…..

The year of 2018

Savannah started the year in quite a

dull way, the share price hovered around 6p, falling to 5.2p during the second

half of April. During this period the mining Licenses for Mozambique were

submitted in January. The most significant activity during the first quarter

was around the Barroso Lithium project, a 200% increase in the mineral estimate

to 9.1m tonnes which led to the kicking off of the initial scoping study for

the project. 200% far exceeded most estimates from the limited drilling that

took place and brought the project very close to the 10m tonne target it

thought it needed in order to prove profitable and attractive.

A small fund raising took place at 5.5p

to enable the company to meet its auditor requirements, as always with most

Savannah fundraisers the placing shares went predominantly to long term

holders.

Of the 8 signatures needed for the two Oman licenses, we

received news that 8 had been received for one license and 7 for the other.

Grandao Extended was announced in April.

“ 90m at 0.96% Li₂O from surface including 31m at 1.06%

Li₂O from surface and 34m at 1.37% Li₂O from 50m in 18GRARC65

Drilling to date at Grandao Extended has defined a zone

of pegmatite approximately 300m long and 200m wide confirming the excellent

potential of the zone”

The Grandao extended provided the first real sign that

this was moving from a potentially good European lithium project, to something

rather special and of real European strategic significance.

Despite the advancement of all projects

during this period, the share price had a very muted response. It was as a I

mentioned above a “dull period”. The market didn’t subscribe any new value to

any of the advancements, I suggest this was in part, due to the small fund raise, in part due to the mining

cycle, but also in part due to the lack of value that the market assigns to news

updates of these types.

As we move into May and June we enter

the “phase of enlightenment”. Throughout this period there was only three major

pieces of positive news, however the share price response was dramatic. From

the 23rd of April to June 11th, the share price rose from

5.26 to 12.69. Intraday highs were actually far higher at 15.25p.

During this period the only news for Mozambique

was that, in conjunction Rio Tinto, Savannah submitted mining licenses for the

mineral sands deposit.

For Oman, the only news was that all

magical signatures were obtained for the two Oman mining areas. The remaining

obstacle left for the company and the granting of the mining licenses was

formal approval by the ministry of mining.

Although the Oman mining license

situation left shareholders expectant, neither of the projects provided the

catalyst for share price increase, this was left to Portugal….

At the start of May, Savannah announced

yet another 52% increased resource upgrade. This came quickly on top of the

200% upgrade less than three months earlier. It was a clear demonstration of

the successful drilling undertaken and proved what many private investors who

had been following the drilling had suspected..

The share price responded and started to

rise, the company made a conscious effort to promote the company, including

articles in national newspapers and trade publications. Based on the

anticipation of the scoping study the share price rose to 12-13p.

On the 14th of June a scoping

study was released.

- ·

14.42Mt at 1.07% Lithium

- ·

IRR of 63%

- ·

£85m Capex

- ·

Pre tax NPV of $356m

The share price responded well and maintained much of its gains.

In the background, like many AIM companies, Savannah was ensuring that

it was fully funded for the foreseeable future by taking advantage of its

higher share price. A share placing occurred on the 5th of July

raising £12.5m at a price of 9p. Although this was below the heights that the

company had reached, it was considerably in-excess of its news start point,

back in April of only 5.2p.

For the rest of July we had the appointment of Primero to produce a

feasibility study and an option to acquire some more land in Portugal.

From the placing in July, the share price has had a near straight

decline until year end finishing back at 5.2p.

It would be an easy mistake, to assume that the company just suffered

the normal AIM fate. The company was funded, the BOD could take its wages for

another year, the company sat waiting on the PFS creation and on the

Feasibility for Portugal.

This didn’t occur, instead the company entered a period of introspective

improvement, from Aug to Dec. As mentioned above its important to note that

this didn’t really change the downward movement of the share price, however

they are the details that make this share so different to many others and

longer term add the most value.

In Sept a further increase in JORC at the Mina Do Barroso Lithium

deposit to compliment the already announced 14mt tonnes was declared. On top of

the 200% increase, the 50% increase, we now had a further 50% increase to over

20mt of lithium.

More drilling was announced in Oman, we presume in order to facilitate

the granting of the permission to mine in Oman.

A further mining license was requested for Mozambique and we finish

September acquiring more mining lease applications for Portugal.

The final few months of the year consisted of agreements with Porto

University and discovery of further zones of mineralisation in Portugal.

In December Savannah released the final significant piece of news with

an increase in its Saleable Co-products. Along with its Lithium production, Savannah

also plans to produce Feldspar and Quartz products from the waste. A specialist

company was employed to assess and find final markets for a bulk sampling that

took place. This waste material was found to be worth approx. 100-150% more

than thought under the scoping study. It is anticipated that, along with other

factors, it will enable Savannah’s lithium mine to be one of the cheapest in

the world and the cheapest in Europe by a very wide margin.

Over the year the team at Savannah was expanded. James Leahy, formally

of Bacanora Minerals joined in Novemeber. Martin Steinbild from Germany joined

in January from Rockwood Lithium (brought by Albermarle Group) as a Lithium

commercial director.

Finally during 2018, Savannah joined the EBA (European Battery Alliance),

it’s a small group of companies under the direction of the EU Vice President to

ensure that the European Union is a driving force in the electric car market.

It recognises that battery metals and the creation of batteries are of

strategic importance and aims to build partnerships between companies to keep

things “European”. Most of Europe’s largest companies, car makers, electronic

giants are members of this organisation. Over the year Savannah has clearly

been leveraging this to its advantage.

Hopefully the above demonstrates that Savannah is very much “the teenage

genius” the possibilities and potential is incredible, the company has made

amazing strides and headways in 2018, achieving things that most, sometimes no

other AIM company has been able to do. Some AIM companies might well brag about

meetings with Asian government organisations. Or Joint Ventures with big

companies, but Savannah takes this to the next level with its Rio Tinto JV and

its EBA membership. Despite all this though the company has had a very troubled

2018 and it is important to realise why?

The lithium commodities market:

2018 was the much clichéd “Rollecoaster” for Lithium. At the start of

the year Lithium prices were red hot, having risen by as much as 50% in the

last 12 months. Nowhere was this more evident than China, which seemed

determined not just to monopolise the lithium market, but to own it outright.

Chinese lithium buyers were paying 20% above the global premium and Australian

lithium hard rock miners were more than happy to take advantage of this, often

in binding offtake agreements. Europe and to a lesser extent the US(with the

exception of Tesla) were coming from behind, planning to build their battery

megafactories to compete with China and only just starting to put offtake plans

in place.

As we progressed through the year we had two important happenings. Firstly

we had the earthquake of Trump. His Chinese trade war has had a major impact on

the Chinese middleclass. It was this emerging middleclass that helped to drive

the Chinese lithium demand, as well as potential export market longer term. The

falling (relatively speaking) Chinese demand and the ever increasing Australian

hard rock lithium turned a demand led boom of a higher price bubble, into a

supply led glut. As we went through the year the Chinese premium evaporated and

prices started a general fall globally.

The second major thing to happen is the rapidly expanding European

battery market. Europe is set to build a host of megafactories. Much of the lithium

supply hasn’t yet been arranged for this and with South America struggling and

failing to meet its production targets, prices in Europe are showing some

strength.

The falling of lithium prices generally and more particularly the

collapse of the Chinese price bubble along with the failure of the S.American

lithium producers has seen a significant fall in the share prices of Lithium

companies over the last 6 months. Savannah Resources has been caught up in

this.

The AIM market conditions haven’t helped conditions either, most reading

this will be well aware that AIM liquidity has fallen sharply as funds and

other HNW investors have left the market. Bottom feeders and quick buck

merchants dominate any rise.

For Savannah resources a further unique affect has been the closing down

of a large position by one of the Institutional investors that partook in the

July placing. This isn’t through any fault of Savannah and is due to the

investor suffering losses and withdrawing from the market.

Along with the effects of the mining cycle, which I have gone into

length with in previous blogs, the lack of news particularly around Oman and

short term nature of investors generally, has allowed the share price to fall

as low at 4.7p recently.

What does 2019 hold for Savannah Resources?

|

Project

|

Performance

Condition

|

Timing

|

|

Oman

|

Commencement

of mining

|

December

2018

|

|

Mozambique

|

PFS

completed and mining lease granted

|

March

2019

|

|

Portugal

|

Feasibility

study completed and a strategic initiative entered into (e.g. securing major

industry contract/alliance/offtake/equity investment from the lithium

industry)

|

March

2019

|

|

|

|

Participant

|

Total

Target Award

|

Form

of Target Award

|

Applicable

Project/Performance Condition

|

|

David

Archer

|

100%

of Salary

|

40%

Cash

60%

Deferred Equity

|

Oman

|

33.34%

|

|

Mozambique

|

33.33%

|

|

Portugal

|

33.33%

Â

|

|

Dale

Ferguson

|

100%

of Salary

|

40%

Cash

60%

Deferred Equity

|

Oman

|

33.34%

|

|

Mozambique

|

33.33%

|

|

Portugal

|

33.33%

Â

|

|

Michael

McGarty

|

100%

of Salary

|

40%

Cash

60%

Deferred Equity

|

Oman

|

33.34%

|

|

Mozambique

|

33.33%

|

|

Portugal

|

33.33%

Â

|

|

Paul

O'Donoghue

|

40%

of Salary

Â

|

40%

Cash

60%

Deferred Equity

|

Mozambique

|

100%

|

As always for completeness I am declaring I have been a long term holder

of Savannah from pretty much the start of the company. Last year I added at

5.8-6.2p and 5.2p and have recently added in the last week between 4.8p and

4.9p.

· * Taken from the RNS dated 13-04-18.

Of the

three projects, I have reluctantly written off Oman. I so wish to see some

value from it, but can’t in good faith say that I expect anything released to

add value. I hope that I am wrong. I hope we get the mining license, get

production started and very quickly earn money. On paper this is what should

happen. However all of that should have happened last year, as per the

management’s incentive scheme.

Mozambique

has an interesting 2019 coming up. During 2018 nothing of real significance occurred

on this project. 2017 saw the completion of the scoping study and the raising

of Savannah’s stake in the JV to 20%. The PFS has been a long time coming, it’s

a considerable project, valued at well over £1bn and Rio Tinto requires a very

detailed set of studies. The next stage in the JV agreement beyond the PFS is a

DFS (Definitive Feasibility Study), which would earn SAV 51% and control on the

JV. It is in this context that the PFS should be viewed.

As

part of the normal mining cycle the PFS would carry considerable share price weight

under normal circumstances. With 1bn+ NPV, profit and revenue figures on a

project that already has one of the world’s largest companies with an offtake

agreement to take 100% of the mined resources this should doubly be the case.

With Savannah resources though the PFS carries even greater significance. IF

Rio Tinto want to carry on to the next stage, (the DFS) it will be Rio

committing to giving Savannah controlling ownership of the JV.

In

every production report for the last few years. Rio has included its Mutamba JV

with Savannah as a tier 1 project. It’s one of only 7 projects in the studies

stage. I have spoken to Rio several times about it, but Rio Tinto have a firm

rule of not commenting on projects until they are pass their PFS. Presumably if

the PFS isn’t good and they don’t want to continue it they can just drop it.

Due to

the above if Savannah and the JV opt to continue to DFS when the PFS is release

or indicate that this is the plan it should create considerable reporting

interest and global coverage. Given all of the above the PFS should add

considerable value to the SP. Obviously I don’t know what the NPV 8 will be on

the project, but I suspect it will be at least 20-25p, probably considerably

higher.

The timing

of the PFS should be soon, to meet the incentive award it has to be by March,

but could slip to April/May. March is also the timeline when the Mozambique

Govt will report back on the mining license application.

This

kind of project, with this kind of JV partner, with firm bankable PFS figures

and a mining license will be many steps up from where we were in 2018.

Moving

onto Portugal, 2018 was anything but a slow year for Portugal, the anchor

effects on the share price should reduce, the China/US spat should show signs

of being overcome. More importantly the demand for lithium for Europe should

start to grow very strongly, possibly resulting in a European lithium price

bubble as we enter 2020-2022 as the food for mega factories is needed.

I am

fully expecting the Lithium resource size to continue to grow at a fast rate,

maybe taking the size of the project to 30-40mt. This would make it one of the

biggest 15 hard rock lithium sources in the world.

The

feasibility study when its produced is bankable and will provide figures far in

excess of the scoping study. A minimum for me is an NPV 8 of 30p. We already

had some of the world’s lowest costs in the project, but with the new figures

on by product prices we should see the project being one of the top 5 hard rock

lithium projects for lowest costs per tonne in the world.

The

IRR of the project, how quickly it will make a return on the capex, is likely

to go even high as profits per tonne increase. Portugal is already one of the

quickest/best IRR’s on the London Stock Exchange, both AIM and Main Index.

To

meet the incentive criteria both the feasibility study and the strategic

partner should be in place by the end of March. Again there is always the

possibility this might slip, however both should be in between March and May

very comfortably.

I

think the strategic partner might well be given some pre release draft

information from the Feasibility creation and that be announced first. My guess

would be in the next 3-4 weeks. Given the favourable location and membership of

the EBA, a strategic partner from the EBA seems most likely and desirable. My

own hunch is a major European car maker, with a tie up to China, allowing

Savannah’s lithium to be process in China until the European processing

capability is in place.

With a

low Capex and a very strong, stable partner and EBA/EU backing, the market

should assign almost NPV 8 value to the project as it would be deemed highly

likely of happening with production next year.

The announcement

of the strategic partner is in some ways more important than the feasibility

study. As we’ve seen recently with the likes of SOLG, when a company has a

large external investor investing into a company it assigns a high degree of

value to company and the share price responds. Not least because we would

expect any strategic company to help fund the modest capex.

So key

share price points.

- Mozambique’s

PFS and Rio’s continual involvement.

- Mozambique

mining license approval.

- Portugal’s

Strategic Partner.

- Lithium

Feasibility Study.

- Lithium

Go decision, funding and construction start.

All of the above should add anything from 10-30p to the share price as a

minimum. After having the foresight to load up on cash at 9p, this is the year

that Savannah moves out of its teenage genius stage, where people other than

its loving family see the value and invest in its future. Where it steps onto

the world stage.

The current share price doesn’t factor any of these factors, nor the

amount of attention that Savannah will be receiving over the coming 6-12 months

as Europe’s largest source of Lithium and Rio Tinto’s partner.

For certain though 2019 will have neither, trials or tribulations.