Bushranger – Racecourse Prospect.

The aim of this

very quick piece of research, is to understand the implications of both the

Market update in the week commencing the 25th of Jan 2021 – which is

a geological interpretation of the visual core findings and the later assays,

which should be available between the 8th -19th of February

for part 1, if they are split in two. Or the 22nd of February to the

5th of March, for part 2, or the entire core length.

This report is not,

and could never be, exhaustive. Hundreds of pages and at least 30 scientific

studies have been written concerning the geology involved and the individual prospects

that have been Identified. Some of the science is still disputed. It would take

many weeks and months to produce a concise report. I would encourage anybody

interested to research in more detail any aspects which they think are too

lightly touched. I’ve tried to stick to details which are relevant, in favour

of comprehensive histories.

From experience the

market often doesn’t pick up on and or understand porphyry geology or results

straight away. As an investor, being able to determine results and the

geological indicators, gives you a heads up, before the market either heavily buys

or sells the explorers share.

I am not an expert in the Xtract Resources

company. I don’t pretend to be. What I do have is 10-15 years investing in porphyry

exploration companies. I am a new investor in Xtract Resources and I have

invested based purely on the drilling of Bushranger. To further caveat this

piece of work, Xtract Resources (XTR), have been very poor at giving out core information

to date. We have very limited visuals and descriptions of the mineralisation.

The stockwork has not been described, we don’t have visual estimates of

percentages or even vein counts. We do thankfully have a few snipets such as

the heavy feldspar presence, some of the existing older drill results and

nearby similarities with extensive geological exploration. As you would expect

we have been told about the extensive chalcopyrite findings, but little on mineralisation

such as bornite, or primary and secondary source events. It has been, and

continues to be my belief that XTR, are still coming to terms with the drill

results. To my knowledge they have a single geologist overseeing operations who

is not a porphyry expert. To remedy this XTR are in the process of hiring and

appointing a local porphyry expert.

All porphyry

systems share similar characteristics, they are intrusions of magma, which undergo

hydrothermal alterations. The mineral composition tends to be driven by how

many alterations and often the speed of the alteration. For example, faster or

slower cooling of the intrusion will provide more or less copper and inversely gold.

So, porphyries tend to be either gold heavy or copper heavy. There is a sweet

spot, with just the right speed of cooling, where both exist in moderate

levels. To complicate matters, geology doesn’t just happen and then stop; so,

you will often have two or more incursions of hydrothermal alteration. This

provides a mixture of stockwork. For example, the older -primary- incursion with

associated stockwork, tend to be gold heavy in this region, later incursions

are normally more coppercentric, which is supported by local geology studies.

Obviously, other factors will be in play and I am simplifying this greatly, not

least that this region probably saw as many as 6, maybe 10 intrusions, in

various stages of hydrothermal maturation. Alteration plays the key role in

extracting, creating the mineralised halo. By far the highest mineralisation is

based directly around the intrusion in the alteration layer. Some intrusions

will exist that are completely barren of gold, copper and silver.

Before we go much

further, it’s important to identify similar localities within the geological

system, that the Bushranger license lies. These are Boda, Northparkes and

Ridgeway. Although, the much larger Cadia system of deposits is within the

geological footprint, it’s characteristics are too different to the Bushranger

prospect to be a much use currently, this might change with new drill results.

Boda: This is a predominantly gold primary; with copper

secondary. Monzonite Porphyry pipes extend 1000m in length horizontally. Boda

has an unusually large alteration zone, extending 400m across. The alteration

zone is fed from several porphyry pipes of various but mainly early intrusions.

Mineralisation has a similar spread to all of these porphyry types, being much

stronger directly next to the intrusion, drill intercepts of 19m @0.82g/t Au. Compared

to 152m @0.18g/t Au as you move 100-150m away from the intrusion, into the edge

of the alteration.

Northparkes: Is a collection currently of five, Length of mine,

(LOM); fingerstyle pipe porphyry systems. Mainly copper but some gold dependent

on the pipe system. “Deposits are typical porphyry copper-gold systems, in that

the mineralisation and alteration are zoned around multiphase porphyritic

intrusions, which are of monzonitic composition. The monzonite porphyries form

narrow (typically less than 50 m in diameter), but vertically extensive

(greater than 1,000 m) pipes. As the copper grade increases (approximately >

1.2 per cent copper), the content of covellite, digenite and chalcocite

associated with the bornite mineralisation also increases.

* Taken from the

Northparkes.com Nov 2020 disclosure report.

Highest copper

grades are generally associated with the margins of the syn mineral monzonite

porphyries, in areas of intense stockwork veining.

Gold normally

occurs as fine inclusions within the bornite; due to the intimate relationship

with bornite, visible gold tends to occur within the highest-grade zones of the

central portion of the deposit.

The

magmatic-hydrothermal fluids responsible for mineralisation circulated in

intricate fracture networks to produce K-feldspar-quartz-sulphate-sulphide

veinlets and quartz sulphide stockwork veins, surrounded by

K-feldspar–dominated alteration. Ore grade copper and gold mineralisation is

exclusively located within the potassic alteration zones, with localised

sericitic alteration overprinting.

Importantly the percentage

of vein coverage is 2-15%.

Ridgeway: The geology of Ridgeway is very similar to Northparkes;

a collection of fingerstyle pipe systems. Ridgeway differs slightly as the vertical

intrusions are dominated by earlier intrusion events, these provide a gold rich

source. The gold rich mineralisation is mainly in Bornite, which is an abundant

sulphide. The later intrusions are more biotite and magnetite, with chalcopyrite,

hence being copper heavy.

Gold mineralised

quartz veins surround 50-100m pencil/finger porphyries, they extend 1000m and

sit several hundred metres below the surface. Both copper and gold

mineralisation is seen in heavy stockwork and sheet arrays. Like Boda and

Northparkes, mineralisation is highest next to the monzonite intrusion core.

Current Jorc 150M/t

@ 0.52g/t = 2.4m oz gold and 0.33%

copper = 0.48m/t

The current JORC is

lower than might be expected as open pit mining has already extracted a

significant portion of the mineralisation. The copper and gold still it situ is

thought to be underground mining only.

The above diagram shows the depth

of Ridgeway, also the very high grades around the edge of the slanted porphyry.

Importantly, It is also very uncertain

whether any geophysical technique would have detected the deposit in the

absence of the Miocene cover. It is debatable whether the 1994 IP survey really

detected the deposit and further investigation into this is warranted. The

deposit is not a conductor and was not detected by post-discovery downhole EM,

even in a hole through the ore. The magnetic response at surface from the

magnetite in the deposit veins is lost in the noise caused by stronger, nearer

surface magnetic sources, which include the primary and alteration magnetite in

the host volcanics and the monzodiorite. * Taken from John Holliday, Colin McMillan and Ian Tedder, at Newcrest Mining.

Bushranger; Racecourse Prospect In Detail:

The Bushranger license area is located in the

Lachlan Belt, just below the main Transverse Zone. It’s to the south in the

Rockley Gulgong Volcanic sub zone. All the main sub zone’s are thought to be

part of the same arc system, which experienced 3 distinct periods of activity. There

is still some debate whether the Rockley zone has undergone all 3 (early, as

well as the second and third which occurred near the same timeframe). There is

growing evidence that it experienced the early activity, but probably to a

lesser degree. Most of the mineralisation occurred in a 30-40m year period

towards the end of the Arc activity.

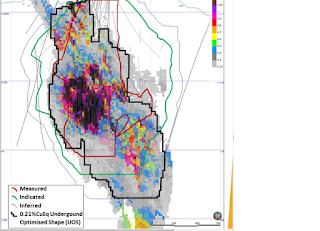

Racecourse has had

several JORC updates. It’s a shame that not all of the data is available, the

commonly used, PropectOre map above is very simplistic in nature and does not

include drill data such as:

RCJ2 - 65m @ 0.60% copper · BRC013 - 52m @ 0.72% copper ·

BRC025 - 49m @ 0.70% copper · BRC014 - 2m @ 8.07g/t gold

The prospect has

been explored by various companies over the past 30 years. Anglo American being

the most well known owner, where they increased the JORC estimate from 27.6 M/t

@ 0.45 copper to a copper gold mineral

resource of 71 M/t @ 0.44% copper and 0.064g/t gold.

The Racecourse

Prospect covers a significant copper (and minor gold) mineralised zone of 1000

metres strike length. The tabular mineralised zone varies from 30 to 130m in

width.

The descriptions,

particularly of Northparkes and Ridgeway are very similar to the expected 3D

mapping of the Racecourse prospect. We should add the caveat, that 3D mapping,

is not the same as good quality geological data. The Racecourse drill

information, has been sporadic and shallow to date. However, we can only go

with the data we have at present.

The depth of

Racecourse has been increased to around 1000m. Known mineralisation has a width

and pipe like nature, at Racecourse. The mineralisation and mineral composition

is very similar to date to that of Northparkes and Ridgeway.

This report has not

been written to try and evaluate the Racecourse Prospect. The purpose of this

report is to ask the questions that we hope will be answered by detailed geological

core date and assays. The first drill - that Xtract Resources has undertaken – has

been to run parallel within the mineralisation of the intrusion. Nearly 1000m

of “mineralisation” has been recorded, according to the company. It will be

impossible to draw any conclusions as to potential resource increases from this

drill.

A common component of both Northparkes and

Ridgeway is the varied pipe intrusions, although it might be easier to

represent the mineralisation as a single homogenous finger. The multiple intrusions

are more like, twisted roots, rising up. Now imagine a different root, growing

up the side of it, sometimes wrapping around, sometimes a little farther away.

Now imagine, roots of different sizes, growing up again and again in the same

place. Some of the roots will be non

mineralised intrusions. Hopefully this

explains how the mineralisation will be a patchy; the copper and gold varying.

The finger/pencil/pipe

intrusions themselves are sourced from deeper, often much deeper areas of

rising mantle.

We can - by looking

at the mineralisation present- determine which of these intrusions are dominant.

The Racecourse prospect, will contain barren and mineralised events. It seems

obvious, but the smaller the barren or lower grade prospects, the smaller the

effects of the barren intrusions. We can understand whether there is a single mineralisation

event, by the stockwork. Ideally we want to see different stockwork present.

It will be very

difficult to see gold or estimate gold mineralisation. As per the already

released statement, Chalcopyrite is seen in a fine grain dispersed form due to

intense alteration. As per all the regional mines discussed here, if Bornite is

seen in a moderate to strong percentage, then it’s a good indicator of

reasonable gold grades 0.3-0.7 g/t. It is unusual to see the gold visually due to

the fine mineralisation. If the visual reports of the drill indicate the

presence of gold, then I would expect some very good gold grades.

It would be good to

get veining and Chalcopyrite percentages from the visuals. Evidence from Northparkes,

is that a percentage of 2-15% would give Northparke type mineralisation.

What evidence is there, that the width of the intrusion is

wider at depth? The position of the follow up drill will likely give an idea of

the updated 3D modelling, the greater the dip the more likely the width.

It is unfortunate that we don’t and I assume

Xtract don’t, have access to Anglo American’s data. They will obviously see the

data points of the JORC. However just as important will be the unsuccessful

drilling and the extent drilling that was not in the JORC. Anglo, will – I have

no doubt- be following the drilling closely and plugging the numbers into their

own private model.

I am now going to outline a few possibilities, none of which

will be proven by drill 1. There are a couple of key aspects. The first is the

mistake that Newcrest made with Ridgeway. They have been open that the IP survey

didn’t, maybe couldn’t, pick up the anomaly at depth. Secondly, these intrusions

are rarely singlular. Even the Northparke finger porphyries have multiple

intrusion nodes.

Scenario 1: A Singular finger porphyry, a continuation of

the current width and grade down to 1000m. This is unlikely given the evidence

of the nearby geology. Even so, it would greatly increase the current copper and

gold content.

Scenario 2: Slightly early intrusions could be evident down

the underside of the main porphyry target. All, of the higher gold grades are

on this side. A test for this could be to drill another longer hole that starts

on the underside, crosses the main body and then goes out on the top side from

700m or so onwards. It would hopefully, be able to test the width at depth, and

prove or disprove mineral continuation on the topside. It might also increase

the gold mineralisation for any future JORC.

Scenario 3: It is still possible that this is not a uniformed

width, finger type porphyry, but instead has far more, wider sheet

mineralisation. The upper section of the porphyry is not as uniform as we would

expect. This might be due to the action that has given it an almost 45 degree dip

from source. However, it is then highly lucky and or unusual that they have

managed to drill to 1000m and stay in the moderate to strong mineralisation.

This provides significant evidence that the porphyry widens down hole. The intrusion

core, is often thicker lower down, as numerous intrusion attempts will not

reach the height of the highest one. For example, an intrusion episode might

reach 700m below ground, the next 100m below ground, then a third 500m below

ground. Thickness might then increase at 700m below surface, 500m below surface

and 100m below surface, in steps.

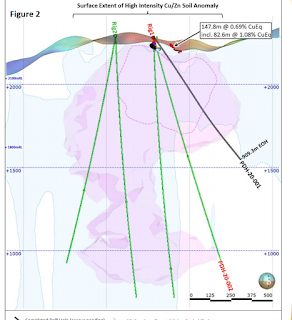

I’ve drawn a drill,

on the diagram below, that would intersect the width at approximately 700m down

dip. If you decrease the dip it will intersect closer to the surface, if you

increase the dip it will intersect at 800-900m. The dip that the geologist choose,

might well indicate how much they think it widens.

Scenario 4: The final possibility, at least that I will

discuss here, is that - similar to Ridgeway, there is a deeper mineralised

system underneath the average mineralisation we’ve seen to date. Many of the reasons

for this, are the same as Scenario 3 and I will not repeat them here. It will

be interesting to see how much the stockwork increases at depth, whether there

is a suitable change in mineralisation. My expectation, is that this would dip

at a similar angle to the already known porphyry mineralisation. I’ve tried to

show in purple where additional core intrusions could push up, a much larger

one to the right of the known body and a smaller one to the left. There is no

way to currently know whether this is the case, or how big it would be. But the

mineralisation to 1000m would indicate, a likely reasonable chance of this and its

likely size.

These are what I

consider - for whatever it’s worth, to be the four most likely scenario’s. The

key points to take are: The presence of bornite for gold; the presence of gold

for strong gold mineralisation. The amount of stockwork (2-15%) and the amount

of Chalcopyrite is also important (Chalcopyrite normally contains 20-30%

copper). The mineralisation will vary, depending on how far away from the intrusion

- how far into the alteration – the drill travels. It will be impossible to say

how much mineralisation there is with a single drill, even with assay results. If

you buy an uncommercial prospect – which is what it was- you are taking a big

risk that you can commercialise it. Uncommercial, it’s worth virtually nothing.

Xtract, have done very well, either by luck or skill, the big increase in depth

will greatly change the tonnage, probably moving it into the commercial

category. It will also, probably, increase the chance that it now matches many

of the similar prospects that extend to depth, also that the wider Bushranger

license area contains additional prospects. That is of course if the new

mineralisation is as described. At a £30m market cap, I am not of the opinion,

that any of the scenarios are priced in.