It’s been awhile again since I wrote one of these, but there

has been more misunderstanding by the Market of the significance of SolGold’s

second discovery Porvenir. For the avoidance of doubt, I hold SOLG shares and

have done continuously since last year, sporadically before then.

Alpala is not a new story, The world of mining knows the

story of Alpala, the worlds largest Tier 1 Copper/Gold project that is

currently not in the hands of majors, although both BHP and Newcrest, now also

Franco, all have finger tips caressing it. The core is quite far down, so block

cave extraction is the answer. This is going to require considerable Capex, but

will be worth it. The story of SolGold has been the story of Alpala.

For me though an untold story was what led me to invest into

SolGold, the story of the regionals. SolGold has the largest amount of

exploration licenses in Ecuador, the most undeveloped mineral area in the

world, something the Market was ignoring -maybe for the obvious reasons of the

world’s number one…..resource-.

However for the last two weeks a different story of SolGold

has been unleashed, due to the first drilling of the none Cascabel/Blanca region

(Alpala’s larger area). The first of these was at La Hueca (pending), now

Porvenir and then by month end Rio.

Porvenir has just completed its first drill and already the

term Discovery has been used. 900m of mineralisation has been logged, which is

considerable in anybody’s book and assays should come around the 5-10th

November. The drill has exceeded all expectations and already laid the groundwork

for a Tier 1 project, which is current 100% owned by SolGold.

Most of this is known in the Market, but it’s the release on

the 13th of October that people haven’t grasped as it demonstrates

the size and bulk of Porvenir. I think it’s worth comparing it with Alpala and

how much it has grown just during the few weeks of this single drill.

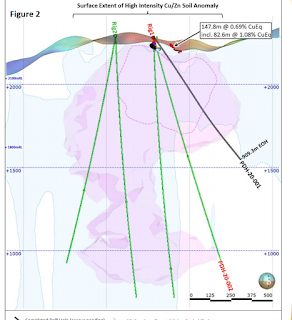

Figure 1. Taken for the SolGold RNS, shows the initial size of

the core and mineralisation area. Drill 1 was planned to intersect the core and

the dispersed alteration zone, shown by IP, along with depth of mineralisation.

The first drill often tries to sample both core and alteration boundaries to

understand the geology and dispersal of the mineralisation, as well as the

presence of A,B and C stockwork. The first drill was expected to reached around

500-600m with low mineralisation at depth. If the drill showed the core near

the surface then Porvenir had a much cheaper Capex route to extraction, smaller

than Alpala, but still a large and very profitable Tier 2 project.

Logging from drill 1 provided some very high 11% by volume

Quartz veining and 6% Chalcopyrite. An excellent shallow core, comparable to Alpala

at its best, It also showed, A,B and C Stockwork indicating extensive

mineralisation episodes. So a very, very happy team of geologists continued

drilling, but the mineralisation instead of taping off, continued..It continued

and it continued. A further higher core was observed at 400-600m and still it

continued, well beyond the IP anomaly, Again A,B and C rework was observed,

where B stockwork was seen, mineralisation was in large, thick veins. This has

continued all the way to 900m. See Figure 2.

Now this would have been amazing, in and of itself -900m of gold,

moly and copper mineralisation is Tier 1- but it’s what it has meant to the

larger mineralisation system that matters.

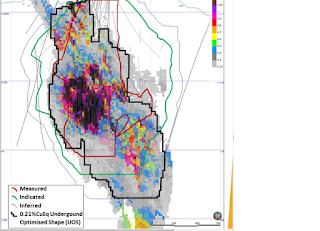

Now lets skip to Alpala, if we ignore the NW zone, which is

pretty low grade and only likely to be mined after 20-40 years, then Alpala is 1500m

deep and 1000m across at a slight dip. See figure 3. The core is obvious and

sits around 500-700m below the surface.

Now a switch back to Porvenir(see figure 4), The core here

is from surface to approx. 500-700m according to modelling and drill 1

intercepts(the red line), which intercepted the core. Figure 4 also shows Purple,

the zone of the very highest grades, along with Yellow the zone of none core

but still high grade. Caveat – mapped using the figure 1, drill 1 visuals and

descriptions and my own estimation. But this still compares well with the

companies own green area of now expected mineralisation.

Moving back to Figure 2, we have the companies further

expectation, drill 2 which will be down to 50m or so by the time this is

published (14th), it will tell us all about the core, its characteristics

and when the assay comes, its grades. It should go to 1400-1500m, intersect all

aspects of the core, help to define the extent of mineralisation width and at a

deeper depth of 500-800m a secondary core, finishing with a third zone of high

mineralisation near the bottom. The hope is that like drill 1, it will continue

to find moderate mineralisation throughout.

The really big hole will be drill 1, from pad 2. As per

figure 2, this should intersect 1600-1800m of high to very high mineralisation.

This should be drilling in 10-15 days time.

Grades are of course as yet unknown, but the prevalence of

Chalcopyrite, along with the abundance of Quartz vein, along with a gold signal

shown by pyrite, all mean that grades should be within the range of 1 to 1.5x

that of Alpala, with a potentially higher core.

Conclusion:

The market has failed to recognise that the news release on

the 13th, increased by a factor of 4 the size of Porvenir. It shows SolGold

has the expectation that Porvenir will be a similar size to Alpala, with a

potential for a greater length and a higher certainty of better grades. The

company for obvious legal reasons can’t say that out right without the drill

intercept, but the ramping up of rigs confirms this.

With the added grades, we are probably looking at something

1 to 1.5x the grade of Alpala.

Without Alpala’s need for two years of digging prior to

commercial extract, Porvenir will be producing quicker and more cheaply. High

grade ore will be commercially available after a few months of preparation work,

once mining complex, tailings has been constructed.

By the middle of Nov, Drill 1 Assays will be available,

Drill 2 will reach depth and drill 1 from pad 2 will have passed through much

of the core. The assays from drill 1 will give much greater confidence of grade

ratio’s and particularly gold content. Combined the middle of Nov will be call

time for the likely size and grade of Porvenir.

SolGold will be the only company in the world with two tier

1 projects, not in the hands of Majors.

By the middle of Nov Rio, which is expected to contain one or

two further potential 1 projects, will have shown visuals and the process of

determination.

No none major mining company in the history of mining has

ever been in pre production majority ownership of 3 or more Tier 1 projects.